I. 5G Industrial Routers and the New Wave of Industrial Automation

Compared with 4G LTE, 5G industrial routers bring three headline-grabbing advantages that directly translate into higher productivity, lower downtime and entirely new automation architectures.

1. Hyper-speed data pipes

The theoretical peak rate of 5G NR now sits at 10 Gbps—an order-of-magnitude jump over Cat-4 or Cat-6 LTE. On the factory floor this means a single router can back-haul thousands of sensor values, high-resolution machine-vision streams and motion-control telegrams without buffering. Cycle times below 1 ms are achievable, so robot arms can follow real-time trajectory updates instead of working from pre-cached paths.

2. Centimetre-level positioning

By combining RTK corrections with 5G’s native positioning reference signal (PRS), an indoor accuracy of <10 cm is realistic. In smart warehouses this allows automated guided vehicles (AGVs) to drop pallets within ±2 cm of the target mark, eliminating the need for magnetic tape or QR-code grids.

3. Network-slicing & massive IoT density

A private 5G slice can guarantee 99.999 % availability to motion control while a second slice carries non-critical CCTV traffic. One radio, logically separated—no more parallel wired fieldbuses.

These capabilities make 5G industrial routers the connectivity backbone for Industry 4.0, predictive maintenance fleets and collaborative robots.

II. Price Landscape in 2025 – What You Should Budget

Prices have fallen 12-18 % since 2023 thanks to second-generation 5G chipsets, but industrial-grade hardware still commands a premium over consumer CPE. The following brackets are FOB China for 1 k units; regional duties, certification costs and operator subsidies can swing numbers by ±20 %.

Embedded 5G industrial router (DIN-rail, IP30, -40 ~ +75 °C, no display):

USD 420 – 1 100 (originally 3 000 – 8 000 RMB)

Industrial PC-grade 5G router (fan-less i5-class CPU, 8 GB RAM, 256 GB SSD, multiple PCIe slots for I/O cards):

USD 1 400 – 2 800 (10 000 – 20 000 RMB)

Hand-held 5G industrial terminal (5.5″ Gorilla-glass screen, barcode scanner, hot-swappable 6 Ah battery):

USD 700 – 1 400 (5 000 – 10 000 RMB)

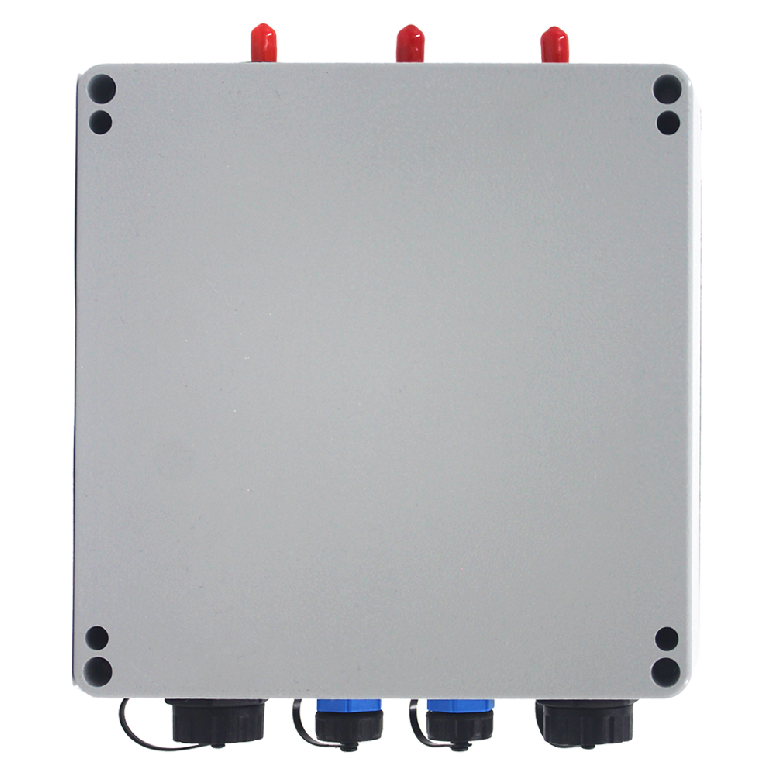

Modular 5G wireless gateway (three fieldbus slots—Modbus, PROFINET, EtherCAT—optional PoE++):

USD 550 – 1 650 (4 000 – 12 000 RMB)

Railway-certified 5G router (EN 50155, IP67, M12 connectors, -40 ~ +85 °C, redundant 110 VDC power):

USD 1 100 – 2 800 (8 000 – 20 000 RMB)

5G industrial Wi-Fi 6E access point (ATEX Zone 2, 4×4 MIMO, 3.6 W per radio):

USD 550 – 1 650 (4 000 – 12 000 RMB)

5G ruggedised smartphone (PTT button, intrinsically safe, 6 000 mAh battery):

USD 420 – 1 100 (3 000 – 8 000 RMB)

Rule-of-thumb: add 15 % if you need dual-SIM with automatic failover, 25 % for IEC 62443-4-2 cyber-security certification, and 30 % for an eUICC that can switch carrier profiles over-the-air.

III. Core Specifications That Drive Cost

Don’t shop on price alone—check these parameters or you’ll pay twice.

Wired Ethernet ports

Look for at least two Gigabit ports with IEEE 1588v2 (PTP) hardware timestamping; 10 Gig-E SFP+ only if you aggregate cameras or micro-cell traffic. Managed switches with QoS at wire-speed prevent cyclic data from colliding with TCP bulk transfers.

Industrial-protocol stack

Out-of-the-box support for Modbus/TCP, PROFINET RT/IRT, EtherNet/IP, OPC-UA Pub/Sub and MQTT(S) saves weeks of gateway programming. Confirm the router can act as a PROFINET controller, not just a device, if you need to control remote I/O nodes directly.

Environmental ratings

Temperature: -40 °C to +75 °C is the safe minimum for metal-clad plants.

Vibration & shock: IEC 60068-2-6 (5 g) and -2-27 (50 g) for stamping lines.

EMC: Level 3 (IEC 61000-4-2) for ESD immunity; Level 4 for surge on power and antenna ports.

Firmware lifecycle

Push-button OTA updates through an encrypted partition scheme (A/B redundancy) let you patch CVEs without scaffolding. Verify the vendor publishes quarterly security bulletins and maintains images for ≥7 years.

IV. Can I Stick My Ordinary Phone-SIM Inside?

Short answer: sometimes, but it’s risky. Here is the long answer.

1. Regional bands & private-network gotchas

5G industrial routers ship with either Qualcomm SDX62, SDX65 or MediaTek M80 modems. Each SKU is factory-tuned to a regional band plan—EU (n1/n3/n28/n78), NA (n2/n41/n71/n77) or CN (n41/n78/n79). A consumer SIM from a high-street carrier will work only if every band the router scans is also supported by that SIM’s profile. Missing one anchor band often drops you to LTE or, worse, to 3G, breaking ultra-low-latency applications.

2. Carrier-policy & IMEI whitelisting

Some MNOs maintain an IMEI whitelist for 5G Stand-Alone (SA). If the router’s IMEI sits outside their consumer-device range, the network may downgrade the link to 4G or throttle throughput to 50 Mbps. Field engineers waste days blaming “poor signal” when the real culprit is a provisioning rule.

3. Power-back-off & thermal limits

Consumer SIM tariffs usually cap transmit power to +20 dBm. Industrial routers run +26 dBm HPUE (High-Power User Equipment) on n41/n77 for an extra 6 dB of link budget—vital when the antenna sits inside a steel cabinet. A phone-SIM will not unlock that power class, shaving 30 % off range.

4. Static-IP, VPN slice & SLA

Automation cells need fixed IPs and guaranteed bit-rate (GBR) bearers. Consumer plans offer dynamic CG-NAT addresses and best-effort traffic. The result: remote PLC polling times out every time the cell reselects.

5. eUICC & multi-IMSI industrial cards

The safe path is a triple-cut industrial M2M SIM or eUICC chip that stores up to ten bootstrap profiles. Providers such as 1NCE, Truphone or Sierra Smart-Start sell cards pre-loaded with EU, NA and APAC profiles; the router can switch IMSI Over-The-Air (OTA) within 90 seconds. Expect to pay USD 3 – 6 per GB and a monthly management fee of USD 0.50 – 1.20 per SIM, but you gain true global roaming plus a 99.9 % uptime SLA.

Compatibility checklist before you deploy

☑ Does the carrier certify the exact modem firmware version?

☑ Are all NR bands (SA & NSA) listed in the router’s datasheet also in the carrier’s 5G coverage map?

☑ Is the APN for private network slicing (e.g., “automation.nbiot”) pre-provisioned?

☑ Does the SIM support 26 dBm HPUE and 256-QAM UL?

☑ Can you lock the router to 5G SA only to avoid fallback surprises?

If any box is unchecked, budget for an industrial-grade M2M plan; the extra USD 5 per month is cheaper than one hour of unplanned downtime.

V. Total Cost of Ownership—A 3-Year Example

Assume an embedded 5G router (USD 700) on a packaging line. Add two high-gain MIMO antennas (USD 120), a 24 VDC DIN-rail PSU (USD 80) and an industrial M2M SIM (5 GB/month at USD 4.50). Over 36 months the hardware + connectivity bill equals USD 700 + USD 120 + USD 80 + (USD 4.50 × 36) = USD 1 002. Compare that with one lost shift (8 h) caused by LTE congestion—easily USD 15 000 in lost throughput—and the 5G premium pays for itself in the first prevented outage.

Armed with the price brackets, specification checklists and compatibility rules above, you can issue an RFQ that separates marketing hype from rock-solid 5G industrial connectivity—and keep the production line humming for the rest of the decade.